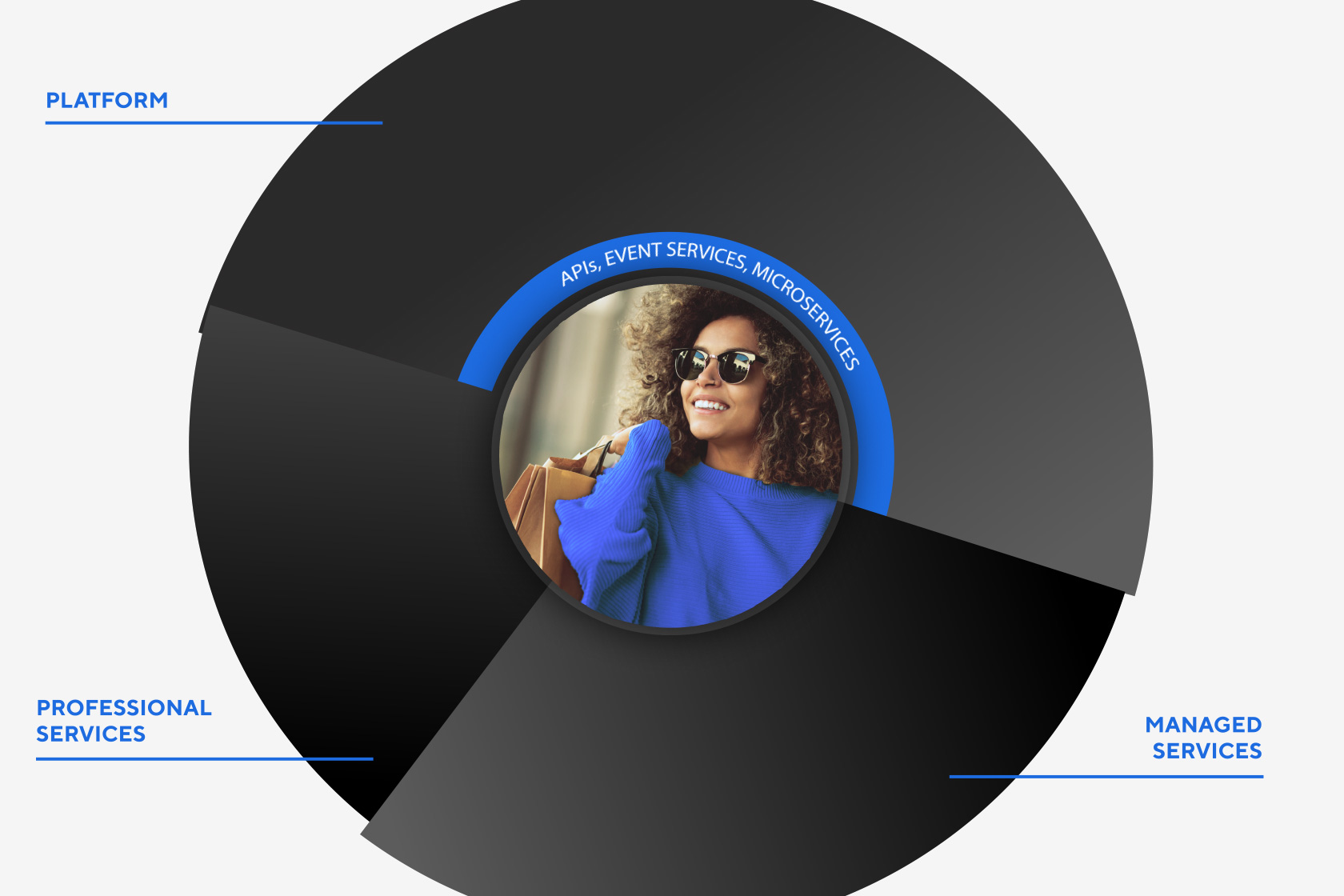

RETAIL OMNICHANNEL PLATFORM

KWI helps retailers maximize sales by uniting their online and in-store capabilities to deliver delightful shopper experiences. With KWI Merchandising and mobile POS, retailers can execute omnichannel flawlessly, and right at their fingertips — clienteling, endless aisle, mobile checkout with the latest payment options, inventory management, and ecommerce.

ALL-IN-ONE OMNICHANNEL SOLUTION

Our suite of solutions can be purchased as modules or come pre-integrated, including: mobile POS, Merchandising, Order Management, eCommerce, Loyalty, and CRM.

Click below to explore KWI’s interactive Retail Omnichannel Platform:

POS

Merchandising

Ecommerce

Order Management

Loyalty

CRM

Global Payments

Helpdesk

Hardware

Customer Success

Integration

Implementation

Merchandising

Distribute, price and manage your products so they’re always in the right place at the right price.

Ecommerce

Pre-integrated into your Merchandising and POS system for an amazing omnichannel experience.

Order Management

Coordinate fulfillment across channels so you can optimize every single sale.

Loyalty

Create seamless customer experiences and unleash your creativity with a fresh new approach to managing loyalty programs.

CRM

Unified, actionable data so you can sell more––with advanced reporting and loyalty programs.

Helpdesk

Always on, always ready to help 7/24/365 for everything from software to hardware.

Hardware

Stress free hardware management including sourcing, configuration & testing, staging, and depot service.

Customer Success

Here to help you get the most out of the platform, optimize processes and adopt best practices.

Integration

Three decades of integrating our solutions into existing business systems. Business uninterrupted.

Implementation

With our in-house professional services, we do it for you and with you so there’s no finger pointing.

WHY KWI?

BECAUSE EXPERIENCE MATTERS

Tomorrow’s tech, today

Think mobile. Think omnichannel. Think unparalleled flexibility and reliability with tons of payment options and lightning-fast speed. In today’s world, your retail tech has to be even quicker and more connected than your customers. Let’s get at it.

One partner for everything

One partner for all your hardware, software, and support. Because calling three vendors to get one thing done isn’t on today’s agenda.

Software

POS, Merchandise/Inventory management, Order management, CRM, and eCommerce.

Hardware

Sourcing, configuration & testing, staging and next-day replacement of in-store hardware.

Support

24/7/365 help desk support, merchant services, implementation & integrations, and a designated customer success team.

Experience and then some

Has retail turned to chaos? Only for brands who can’t keep up. KWI has been moving at the pace of retail for over three decades. Our obsession is helping you stay one move ahead so you can sell more than you ever thought possible.

Retail tech has been our core competency since we started out decades ago. 100% of our customers are retailers. 100% of our R&D is in retail. 100% of our obsession is retail.

30B

$30B

transactions

managed

98%

98%

customer

retention

0

0

BS or

red tape

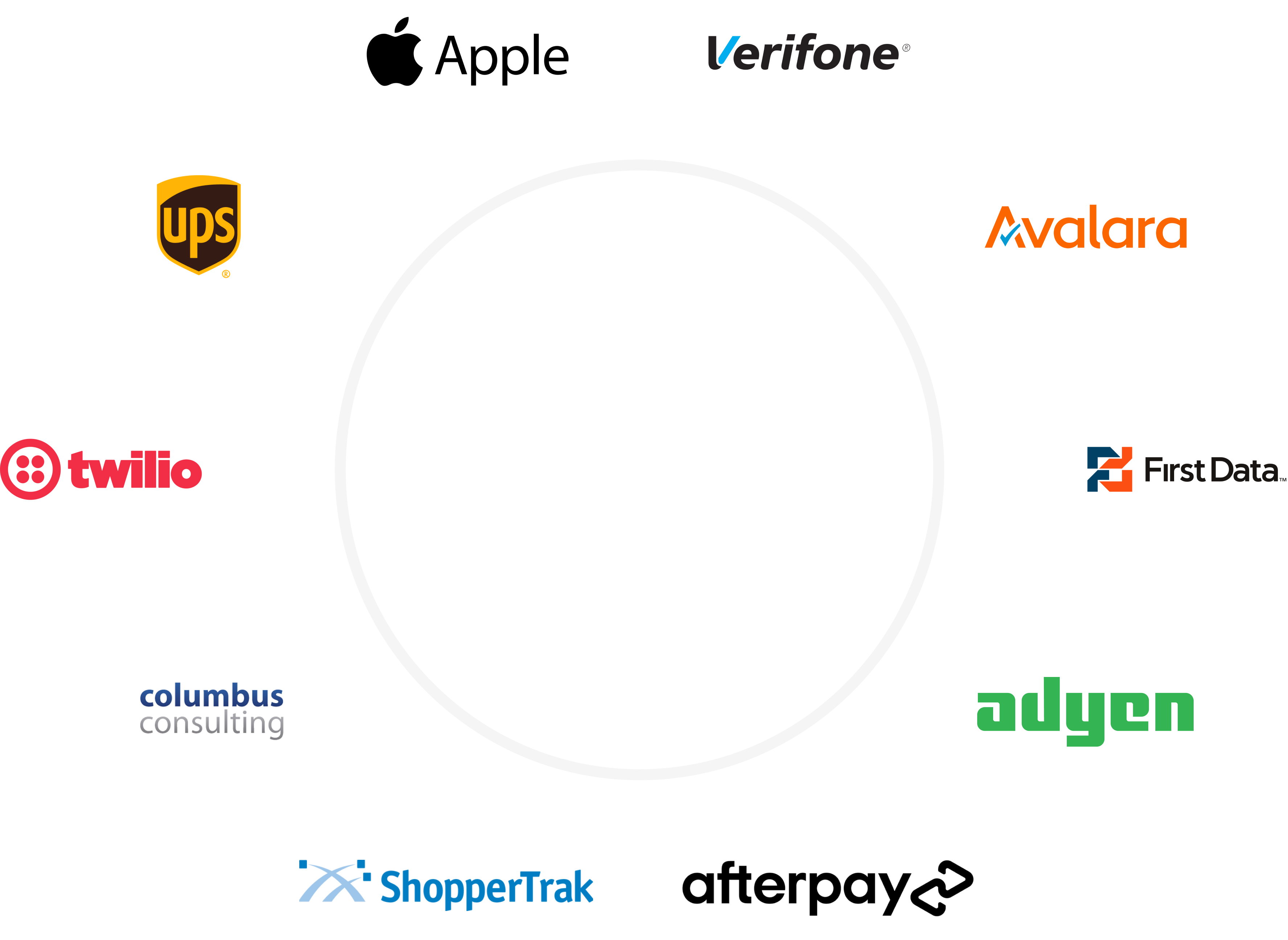

Seamless Integration with the partners you rely on

Speak to a retail expert

Take the first steps towards launching a modern retail omnichannel platform.